Fiona.com readers earn up to $55 when you sign up for RoarMoney℠ and connect a qualifying recurring direct deposit.

Scan this on your mobile device to get started

or enter your email to receive your code

“I love the fact that they offer advances when you are in need of some extra money for unforeseen expenses. Thank you MoneyLion for always being here when I need you.”

MoneyLion is a financial technology company, not a bank. RoarMoney℠ is powered by Pathward, N.A., Member FDIC.

MoneyLion is a financial technology company, not a bank. RoarMoney℠ is powered by Pathward, N.A., Member FDIC.

Get paid up to two days early.1

Unlock up to $1,000 in 0% APR cash advances with recurring direct deposits.

Round Up your spare change from everyday purcahses to buy Bitcoin or help build your investment account.

Add funds on a custom schedule with Auto Deposit — just set it and forget it!

Transfer money or cash out in minutes with Turbo transfers.

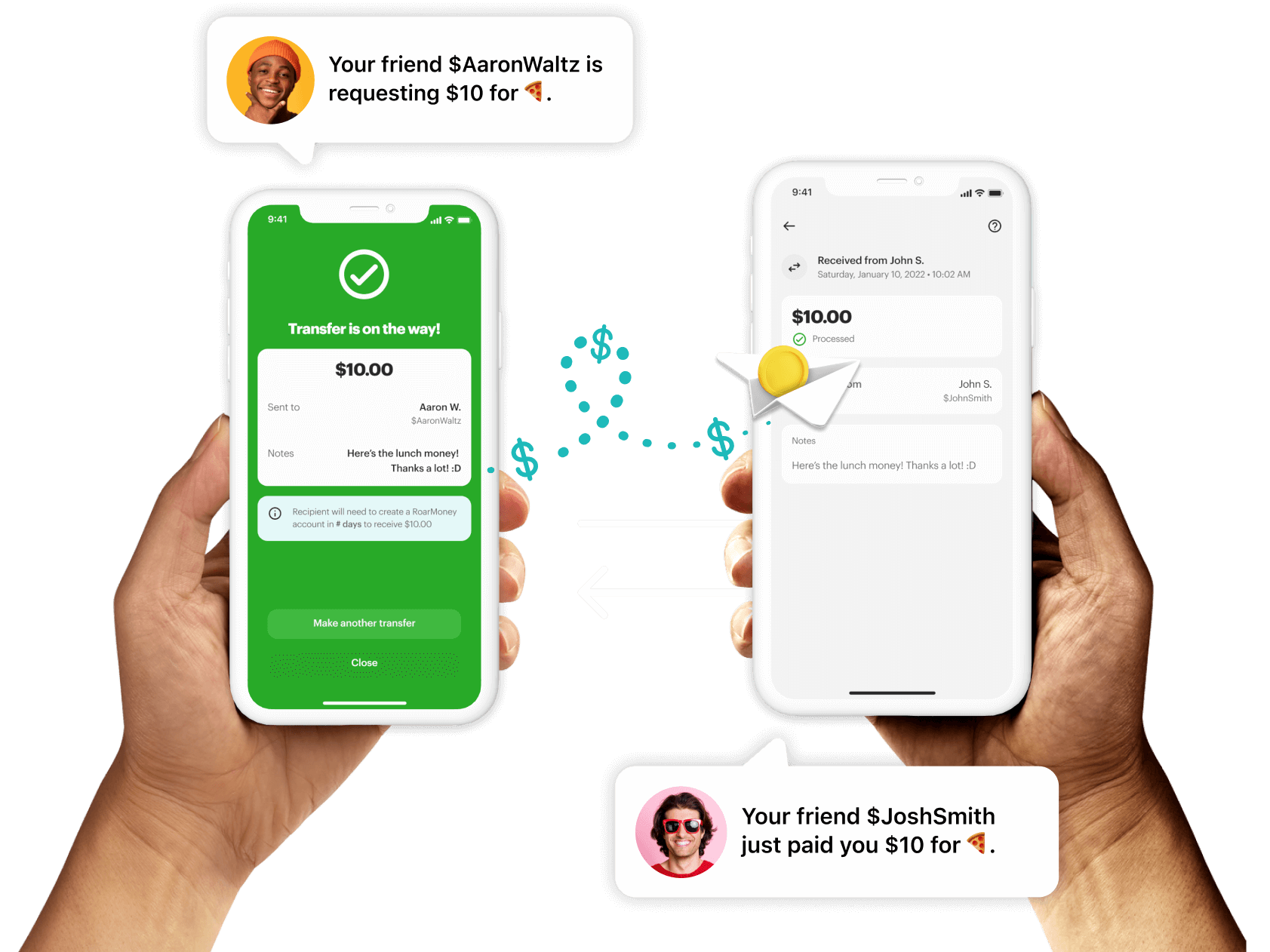

Instantly send money to anyone, for free using MoneyLion Pay**.

And we’re transparent about the few fees we do have.

Now you can use your spare change to buy Bitcoin or invest into an Investment account using your existing debit or credit card. Just set it, forget it, and shop — we’ll take care of the rest.

Learn more >

Found a cheaper price for your headphones? With Price Protection, if you find a lower price within 90 days of an eligible purchase, you can get a refund for the difference up to $500 per claim, 4 times per year.3

What if you could earn cash back when you spend? Get cash rewards every time you spend $10 or more — just by shaking your phone — with Shake ′N′ Bank.4 It’s a surprise every time! You can earn up to five times the value of your purchase, all the way up to $500. You'll also find cash back offers and other discount deals from top online merchants — like Walgreens, Sam's Club, Groupon, DoorDash, and more — in the rewards tab of our mobile banking app.

Bank with control and confidence with industry-leading capabilities like multi-factor authentication, contactless payment, and robust protection against unauthorized purchases5 if your card is lost or stolen. Plus, lock your card instantly in the app anytime!

Master your spending and budgets with smart tools that help you monitor your total financial health in one place. Get weekly reports to help see your spending habits by category.

MoneyLion is a financial technology company, not a bank. RoarMoney℠ is powered by Pathward, N.A., Member FDIC.

It’s easy and takes just a few minutes! Download the free MoneyLion app from the Apple or Google Play store and register for a MoneyLion account with a few pieces of personal information, including your name and your email address. Once you have created an account, we will need to confirm your identity. To do this, we securely and quickly gather additional information from you, including your Social Security number, address, and date of birth.

Once we have verified your identity, you can tap the RoarMoney banner in the app or select the RoarMoney product from our listing of products to set up your RoarMoney account in just a few steps! To start making the most of your account, you should link an external bank account and transfer funds or set up direct deposit. Note that you must be 18 years or older and a resident of the fifty (50) United States or the District of Columbia to be eligible for RoarMoney.

RoarMoney will not charge you hidden bank fees associated with your account! Any fees will be disclosed to you. You have access to 55,000 free Allpoint ATMs, but if you use an ATM that is outside of the Allpoint network, you will incur an ATM fee of $2.50 + whatever the out-of-network ATM / financial institution charges (typically $2-$5). These fees apply to both domestic and international ATMs.

If you choose to expedite your physical replacement card, this will incur a $25 fee. This will allow you to receive your card within 2-3 business days.

There is a $1 monthly administrative fee associated with your RoarMoney Account. Please see FAQ on administrative fee for additional information. Other fees associated with the RoarMoney Account including, send a paper check for Bill Pay and adding funds via external debit card will apply. See account agreement for more information.

First, you don’t need to wait for your card to arrive in the mail to start using your new RoarMoney account. As soon as you sign up, you can activate your RoarMoney virtual card and set a PIN by calling our automated activation line at 801.736.2453 and use it to shop online, by phone, and everywhere that accepts mobile pay after adding funds into your RoarMoney account. You find your virtual card in the Finances tab of your MoneyLion app.

Before we’ll mail you a card, you need to add funds of any amount or set up a direct deposit in the MoneyLion app. As soon as you do, we’ll mail you a MoneyLion Debit Mastercard®! It typically takes 7-10 business days from the day you add funds into your account until you receive the card. You should expect your debit card to reach you by the end of the 10th business day.

If you haven’t received your card after 11 business days, please double-check that your address on file is correct using the MoneyLion mobile app (you’ll find your address in the Main Menu by tapping your profile picture). If you need to update your address, you can click Edit next to the address.

If you have not yet added funds to your RoarMoney account, please do so by transferring funds from another linked account OR by initiating direct deposit through the MoneyLion mobile app or with your employer. Learn more about how to add money to your account here.

No, we don’t check your credit history when you apply for a RoarMoney account, and applying will not affect your credit score.