MANAGED INVESTING

Autopilot Your Wealth

Start with as little as $11 to get a fully managed investment account tailored to your goals. You set your risk level. We'll do the rest.

Discover Feed

Simple, Smart Investing with Managed Portfolios and Daily Insights

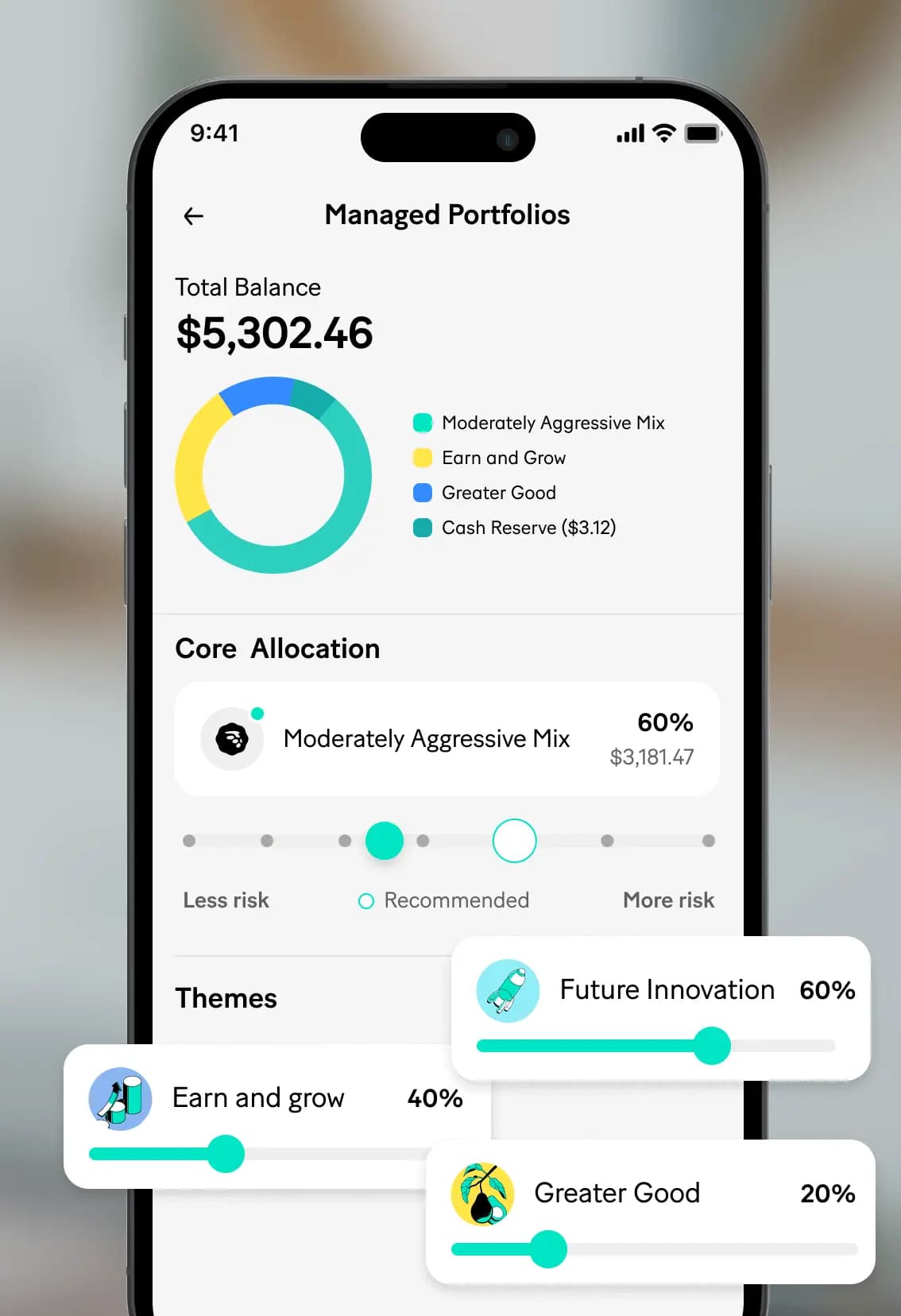

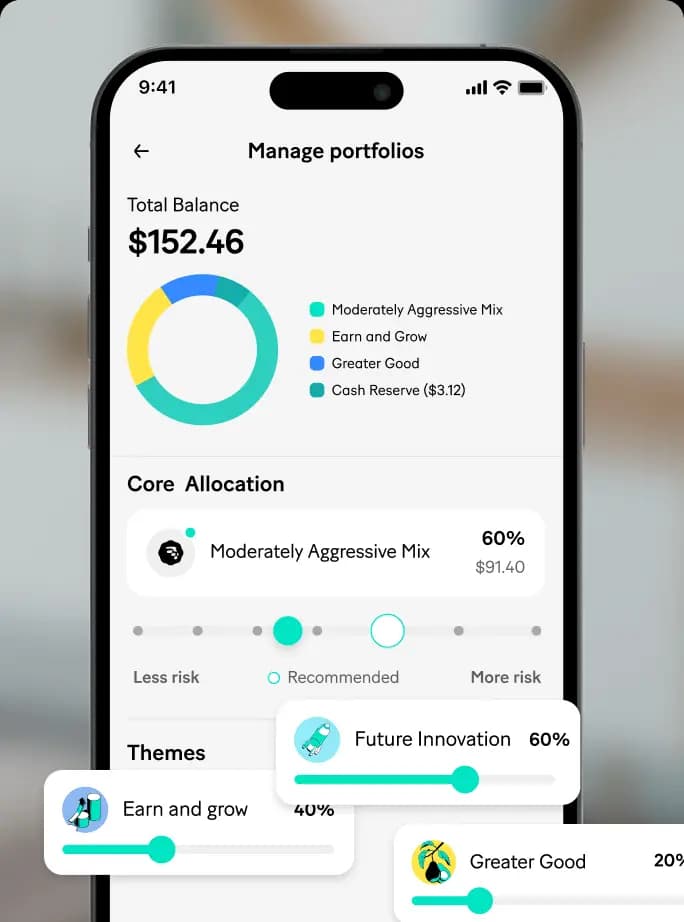

Invest your way, anytime

Simple and Intuitive

Take Control Of Your Portfolio With MoneyLion WOW

How Does Managed Investing Work? Easy.

Answer a few questions to personalize your portfolio.

Fund your account by linking your external bank accounts or your RoarMoneySM Banking account.

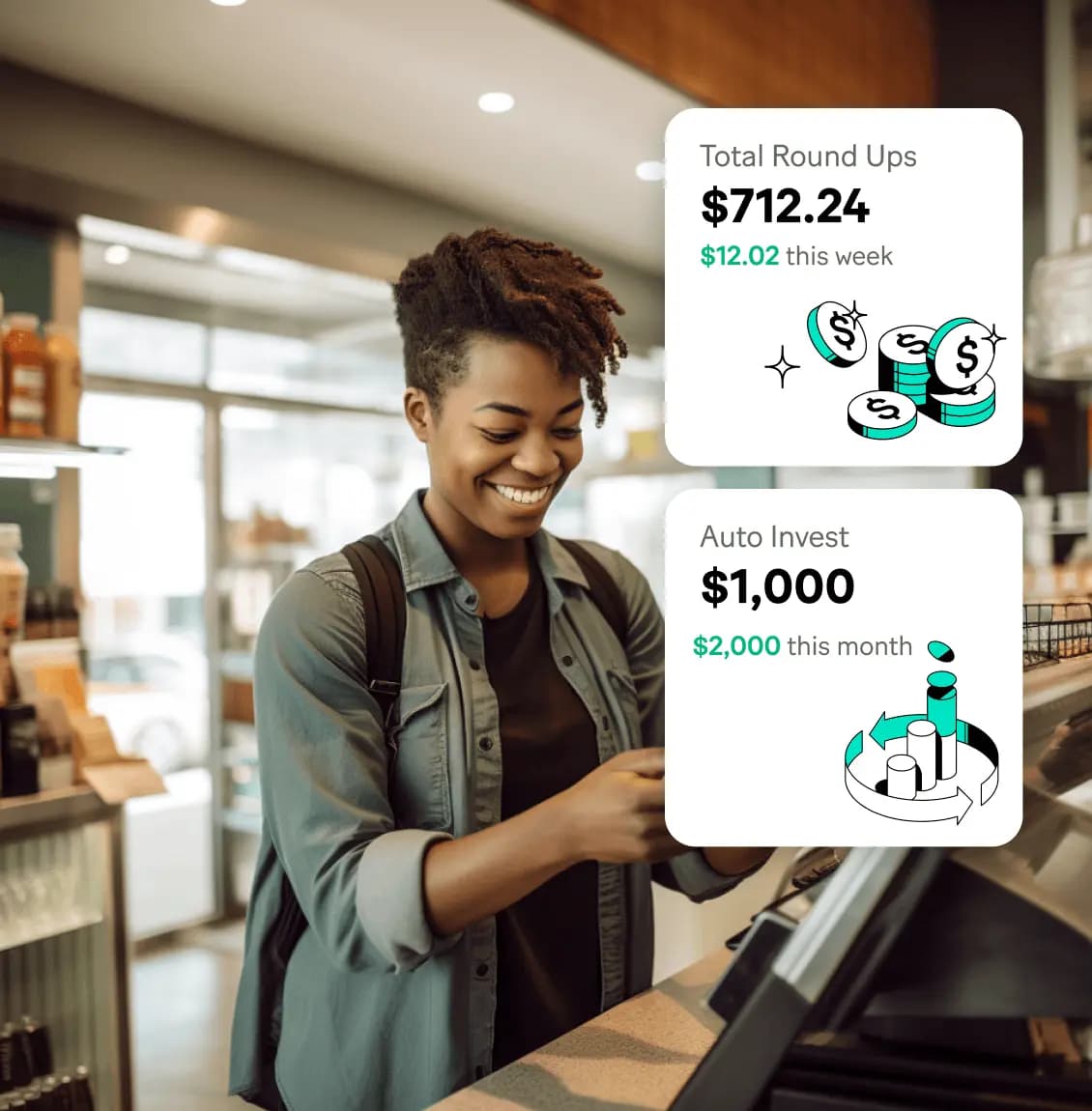

Customize your account to fit your needs with Auto Invest, Round Ups, Thematic investing, and more.

You've got questions. We have answers.

What fees am I charged for my MoneyLion Investment Account?

Unlike some other managed investment accounts, the MoneyLion Investment Account has no ongoing management or trading fees. There is a tiered monthly account fee on our investment accounts:

- $1 for accounts valued up to $5k

- $3 for accounts valued over $5k, up to $25k

- $5 for accounts valued over $25k

In addition to the account level expenses described above, the ETFs in which you invest include embedded expenses that will reduce the ETF’s net asset value. These embedded expenses will reduce the ETF’s performance and will, therefore, reduce the overall performance of your portfolio.

For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure

Can you explain my personalized asset allocation?

Working with our partner Wilshire Associates, a 30-year investment industry leader that manages the assets of some of the nation’s largest institutional investors, we have developed five asset allocation portfolios. Each one offers a distinct balance of associated risk and return expectations. We’ll recommend one of these portfolios for you based on the risk preference questions you answered when you joined MoneyLion.

Here are the five core portfolios, each based on a preferred level of risk:

- Conservative portfolio: Seeks to protect your portfolio by weighting heavily to fixed income (bond) ETFs, with a smaller proportional allocation to equity (stock) ETFs, offering liquidity and targeting stability but offering lower potential returns.

- Moderately conservative portfolio: Seeks to protect your portfolio by weighting more heavily to fixed income ETFs while also seeking to achieve some growth by adding some weighting to equity ETFs.

- Moderate portfolio: Seeks to achieve growth and reduce risk by weighting to fixed income ETFs and equity ETFs fairly evenly, but with a slight tilt toward equities. It may experience some volatility (but most likely still less than the volatility of the overall market) in pursuit of long-term growth.

- Moderately aggressive portfolio: Takes on higher risk to seek higher potential long-term returns and is typically weighted more heavily to equity ETFs, but with some weighting to fixed income ETFs to help cushion against volatility.

- Aggressive portfolio: Takes on substantial risk in an attempt to maximize returns and is heavily weighted to equity ETFs, with a small (typically 20% or less) weighting in fixed income ETFs, and may endure extensive volatility in pursuit of higher long-term gains.

You can always view your current portfolio of funds (and the amount allocated to each) in the MoneyLion app.

The Risk Slider offers two additional asset allocation portfolios beyond our five risk-based portfolios, which allows you to further customize your investment experience.

- The first option is an Aggressive equity-only portfolio. This is for investors with longer time horizons who want to take on higher risk in pursuit of higher gains investing only in equity (stock) ETFs.

- On the other end of the spectrum is the Steady income portfolio. This is a highly conservative portfolio designed to grow your cash at a faster rate than a traditional savings account would by investing in bond ETFs instead of holding cash. The conservative investments would provide you with lower exposure to market fluctuation while producing investment income. It’s our most conservative option, and although your returns may be lower in this allocation than other portfolios, you’ll experience greater protection from market downturns.

How often can I change my asset allocation?

You can change your portfolio allocation no more than approximately once every five days. This is because, when you change your allocation, it requires us to sell and buy shares in your account to rebalance your assets to your new allocation. To make sure your portfolio change is correctly and efficiently processed, we need at least five days to complete the process.

However, it is best practice not to make frequent changes, as your portfolio is meant to be for longer-term investing. Changes should not be made more frequently than once or twice a year, because the allocation reflects risk parameters, which should only change if your preferences or financial situation change.

Have More Questions?