MoneyLion works with Wilshire, one of the nation’s largest investment research consultants, to bring you investment advice and market insights. Each quarter in The Macro View, we bring you Wilshire’s quarterly viewpoints on the big economic stories, with insights about the asset classes that may appear in your investment portfolio. Let’s dive into the latest quarter.

The Macro View

Wilshire Investment strategy update — May 2022

Following a protracted era of low interest rates, benign inflation, and stability among the world’s largest and most powerful nations, the start of 2022 delivered a number of surprises that upended long-standing trends and dramatically changed the market environment. Inflation surged to highs not seen in 40 years, spurring the Fed to act more quickly than many previously anticipated. The combination of Omicron concerns and oil trading at new multi-year highs pushed the VIX (investors level of uncertainty) to a 52-week high. Then, Russia escalated the conflict that began in 2014 by launching a full-scale military invasion of neighboring Ukraine, the largest military action in Europe since World War II.

While the humanitarian impact must not be overlooked, it is also necessary to understand the economic and market impacts that stem from these destabilizing events. Perhaps the most important tensions came from accelerating inflationary pressures the Russia/Ukraine conflict imposed on the Federal Reserve. The Fed had already signaled it would soon raise the fed funds rate, and inflation for the first two months of the year had already climbed 1.4% (not annualized). The market seemed to quickly understand that the Fed needed to act aggressively throughout 2022 to stave off runaway inflation. The 10-year breakeven inflation rate pushed toward 3% and fed funds futures are now pricing an implied overnight rate of nearly 3.00% by the end of the year.

In this quarter’s update:

Wilshire discusses the potential impact of inflation and tighter financial conditions on equities and fixed income, as investors balance the impact of higher interest rates against earnings growth and a relatively healthy global economy. As real rates continue to rise, more attractively valued segments of the US equity market have materially outperformed, which informed our decision to remove our underweight to US growth equities. Given the substantial rise in interest rates and slowing albeit healthy economic growth, Wilshire has also removed our underweight to duration risk and moderated our underweight to core fixed income in favor of more flexible/alternative mandates. Wilshire also recognizes that sentiment is prone to overreaction, and investors should give some credence to the risk that markets might be overpricing the risk of inflation in the short-term. Wilshire continues to view inflation as a risk in the near-term and has removed its overweight to commodities, seeking to monetize positions as volatility works in our favor. Wilshire provides a summary of our positioning, rationale and supporting exhibits in the following sections.

Asset class perspectives May 2022

- Fixed Income vs. Equity. Despite a relatively positive economic outlook, which would normally be expected to benefit equities, valuations are not materially more attractive in equities vs. fixed income, resulting in a neutral view.

- Large Cap vs. Small Cap Equities. Wilshire does not see a meaningful valuation opportunity between large caps and small caps.

- Growth vs. value equities. Given the sharp correction in growth equities coupled with a slowing outlook for GDP and earnings growth, Wilshire has removed their underweight to US growth equities and moved back to a neutral position relative to US value.

- Global ex-US vs. US equities. The geopolitical conflict and the uncertainty it causes for the European economy and equity markets drove our decisions to remove our overweight to ACWI ex-US relative to US equities.

- Emerging markets vs. developed equities and US Valuations are more attractive in emerging markets with higher earnings growth expectations in 2022/2023. Additionally, Chinese policy makers have recently signaled a supportive stance toward the economy and capital markets with an emphasis on stability. China also has the potential for further monetary easing as opposed to monetary tightening seen in various developed markets.

Macroeconomic Outlook: Slower Growth & High Inflation, But Recessionary Risks Remain Unclear

The combination of strong demand, supply chain disruptions, and labor shortages has led to unusually high inflationary pressure, which was further exacerbated by the war in Ukraine. This has fueled concerns of slowing economic growth across most major economies in 2022 and 2023, as financial conditions begin to tighten, and higher prices may begin to cut into residual incomes, eventually weighing on consumption. Nevertheless, global economic growth expectations remain healthy into 2023 relative to history (Exhibit A). Furthermore, global PMIs for both manufacturing and services continue to signal expansion across nearly all major economies. (Note: PMI stands for Manufacturing Purchasing Managers’ Index, which measures the activity level of purchasing managers in the manufacturing sector.)

Exhibit A: global economic growth expectations remain healthy into 2023 relative to history

Following strong real GDP growth of 6.9% during the fourth quarter of 2021, first quarter growth showed that the US economy contracted on an inflation adjusted basis by -1.4% (Exhibit B), primarily due to Net Exports, which contributed -3.2% to GDP. Fortunately, Personal Consumption Expenditures remained strong in the first quarter, contributing +1.83% to GDP, an indication that higher prices have yet to materially impact consumer demand in the US.

Exhibit B:

Significant attention has been given to the flattening of the US yield curve, as measured by the yield spread between 10-year and 2-year US Treasuries (Exhibit C). This measure has historically been a good indicator of economic growth expectations, particularly upon inversion (when the spread becomes negative), which occurred very briefly this year and has historically been shown to precede economic recessions (shaded in red). One of the primary reasons that a flattening yield curve has been a historically good indication of slower growth and recessionary risk is that credit growth slows materially because financial institutions are disincentivized to lend when the curve flattens. The spread between 10-year and 3-month yields has a much more direct relationship to lending activity, and investors should recognize that this spread has actually been steepening, an unusual and important divergence relative to history, which may call into question the efficacy of recent concerns of a pending US recession.

Exhibit C:

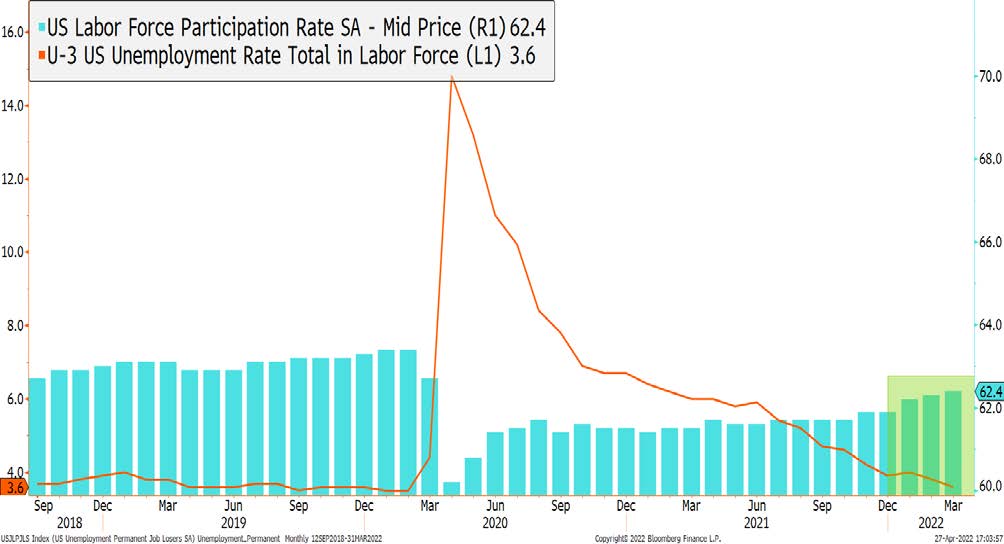

Inflation continues to be one of the most significant risks to global economic growth. The combination of government stimulus and excess savings during the COVID-19 pandemic resulted in strong household balance sheets. This, in combination with personal health concerns, likely contributed to a shrinking labor force in the face of strong demand for both goods and services, which has resulted in a labor shortage and has fueled substantial wage inflation as employers compete for a smaller pool of workers. Fortunately, the combination of economic uncertainty, rising inflation, deteriorating savings, and higher wages appears to be drawing workers back into the labor force. As shown in Exhibit D, the US Labor Force Participation Rate has been increasing over the past several months, which may be an indication that the material rise in wages may start to lose momentum, as the supply and demand of workers moves toward equilibrium. Nevertheless, Wilshire must acknowledge that the labor market is still very tight. Wage inflation is sticky and transmits through to higher inflation elsewhere, as employers pass along higher employment costs to consumers in the form of higher prices for services and goods.

Exhibit D:

While wage inflation is sticky and has resulted in higher consumer prices, the recent bout of inflation is unlike the hyperinflationary environment of the late 1970s/early 1980s when sticky components of the CPI fueled the rapid rise in inflation. Most of the rise in consumer prices during this cycle has been attributable to flexible measures of inflation (Exhibit E). These prices are unlikely to rise at the recent rate and may actually be somewhat mean reverting, as the combination of weaker demand and high base effects lead to lower year-over-year comps. Furthermore, a material rise in mortgage rates has already led to indications of slowing housing activity, as Existing Home Sales and Pending Home Sales continue to decline on a month-on-month basis, which may eventually weigh on home prices and owner equivalent rents.

Exhibit E:

Sentiment: Tighter Conditions Lead to Weaker Sentiment

Wilshire’s Financial Conditions Indicators capture changes in monetary policy, credit conditions, and exchange rates. As shown in Exhibit F, financial conditions in the US and U.K. have risen sharply to the high end of the neutral range.

Exhibit F

Sentiment among analysts has also weakened, particularly on a year-to-date basis. As shown in Exhibit H, Wilshire is witnessing a higher number of downgrades relative to upgrades on a global basis.

Exhibit H

The combination of higher inflation, economic uncertainty, tighter financial conditions, and the resulting asset price volatility is leading to deteriorating market sentiment, which has been gradually weakening over the past 12 months (Exhibit G).

Exhibit G