Markets: Recap and Outlook

The legendary investor Warren Buffet has said that investors should be “fearful when others are greedy and greedy when others are fearful.”

Only a year ago, investors were fearful of a bear market and economic recession. And yet, those investors who remained calm and held onto diversified portfolios in 2019 were rewarded. Buffet’s theory was right again.

So why were stock and bond markets up over the past year, what can investors learn from this, and what is the most important takeaway heading into 2020? Let’s take a look.

Solid 2019 for stocks and bonds

Stock markets are riding high as we approach the end of the year. As of December 23, 2019, the numbers were looking good:

- The US stock market has returned nearly 31.2% (per the S&P 500).

- International developed markets are up 22.1% (per the MSCI EAFE Index).

- Emerging markets have gained 18.3% (per the MSCI Emerging Markets Index).

- A broad diversified portfolio of bonds has generated over 8% for investors (per Barclay’s Aggregate Index).

Why was 2019 so good for investors?

There are a few key drivers behind 2019’s solid performance.

The US economy was healthy

Perhaps the most important reason that many investments have done well is that the economy is still healthy. The recession that many investors feared didn’t occur, and few economists now expect a recession in the near future.

The unemployment rate across the country is at a 50-year low, and consumer net worth is at a record high. While this doesn’t mean that all Americans are doing equally well, it has been enough to push stocks higher.

The Fed lowered rates

Another important reason for this year’s gains may be that the Federal Reserve is pouring stimulus into the system. The Fed made a full U-turn from raising rates last December, which typically slows the economy, to then lowering rates in July. In doing so, the Fed effectively made it cheaper to borrow money, which tends to stimulate the economy and the stock market, usually through increased corporate and consumer spending and lower interest rates on fixed income investments. This excited many investors, resulting in stocks hitting new all-time highs.

2018’s volatile ending

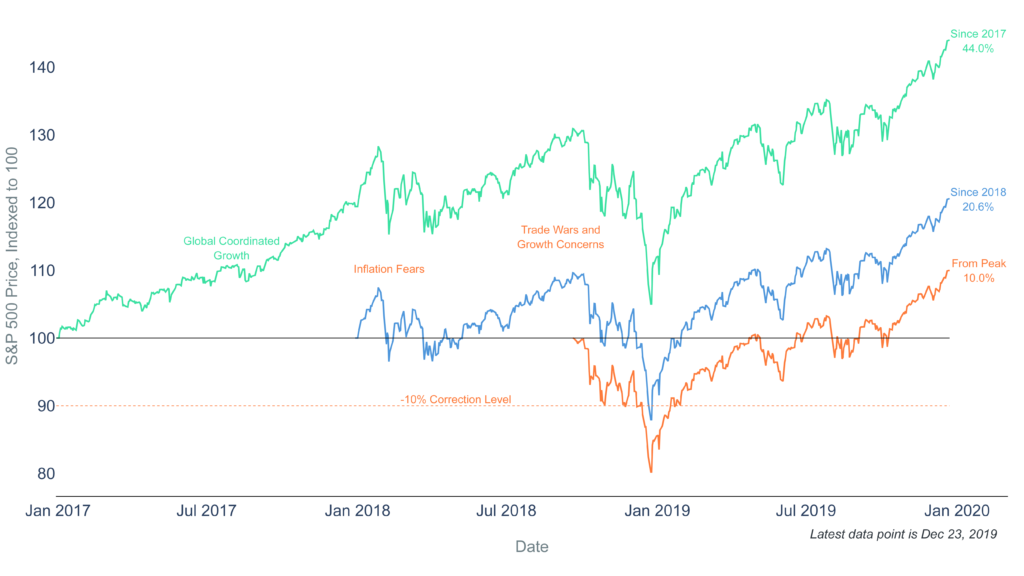

Finally, there is a technicality to be aware of that somewhat magnified the stock market return numbers in 2019. Because 2018 ended near the market lows, a significant part of this year’s return was simply returning to previous levels.

From last year’s market peak to today, the U.S. stock market (S&P 500) has gained about 11% with dividends (total return). While this is still a terrific return, it’s not quite the 30% number that will be advertised in news headlines.

You can see the impact of 2018’s year-end lows illustrated in the chart below. The majority of 2019’s returns were actually a recovery climb to get back up to 2018’s high, and the market didn’t catch up to 2018’s high until about the late 3rd quarter of 2019.

As you can see, while 2019 was a good year from a growth perspective, a lot of that growth was catching up to where we were before October of 2018 — eventually moving to new highs. This brings us back to one of our favorite points: Patience pays off!

Source: Clearnomics, Standard & Poor’s and MSCI

Key 2019 lesson: Patience pays off

If you’d gotten fearful and left the markets when they dropped in late 2018, you’d have missed out on the recovery. But if you stayed the course, and maybe even added to your portfolio when prices were down, you would have benefitted from the recovery and growth that continued throughout 2019.

The unavoidable truth about investing is that there are always reasons to be worried. All of the recent investment gains happened despite negative or noisy headlines and investor concerns all year long.

From the trade war between the U.S. and China, concerns about the Fed, the so-called “Brexit” as the UK breaks up with the European Union, to the upcoming presidential election, there were many worrisome headlines in 2019. These caused the stock market to temporarily drop three times over the course of the year.

Despite this, investors who stayed disciplined were rewarded in the end. Thus, an important skill when investing over the long run is to be able to see past short-term news. The fact that the economy stayed healthy and a trade deal was eventually reached meant that much of the hand-wringing by investors during the year was all for naught.

2020 Outlook: Stay focused in an election year

On that note, one challenge investors will face in 2020 is that media attention will focus on the presidential election. There will be endless speculation, uncertainty, and concern over what each candidate will mean for the stock and bond markets. And while elections are incredibly important for us as citizens, voters and taxpayers, investors should avoid overreacting or jumping to conclusions based on political preferences.

The reality is that it is very difficult to predict how the stock market responds to elections. In fact, investors have feared that just about every presidential candidate in history would spell the end of economic growth and bull markets. In recent times, this was certainly said of both Presidents Obama and Trump.

While economic policies can certainly make a difference over time, investors are usually better off focusing on what affects portfolios in the long run like economic and corporate performance, rather than reacting to day-to-day political headlines. In other words, investors should stay invested and save their energy for the polls.

Uncertainty can cause short-term volatility in the markets, but being patient and staying the course is key. As a best practice, when the market swings because of headlines, try to avoid selling to withdraw funds or making changes to your portfolio, as investor patience is generally rewarded in the long run and it is difficult to time market swings.

Diversifying investments in 2020

Just as many investors were perhaps too fearful at the end of 2018, some investors may be feeling too greedy as we end 2019. With stocks up significantly this past year, many may continue to expect similar gains.

While we can be grateful for a strong year, investors should have realistic expectations. The most important takeaway is that many of the reasons that stocks rose last year, which we discussed above, may be of less help in 2020. Today, very few investors are worried about a recession and the Fed is already stimulating the economy.

Stocks can still do well if the economy is healthy, but we shouldn’t expect the U.S. stock market to rise another 30%. Remember the average annual return for the S&P 500 is 7%. (And market strategists across Wall Street are predicting a range of 5 – 10% total returns for the S&P 500 for 2020).

Holding a diversified portfolio can help you benefit from stock market gains while protecting from uncertainty. We believe this should continue to be the case in 2020.

DISCLOSURE

Investment advisory services provided by ML Wealth, LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclaimers relating to the MoneyLion Investment Account, see Investment Account FAQs and FORM ADV. Broker-Dealer may charge a $0.25 withdrawal fee, among other fees. Accounts are subject to administrative fee of $1 per quarter.