never-quite-enough loop where your money disappears before you can even blink. If you’ve ever checked your bank balance and wondered, “Where did it all go?” — you’re not alone.

The good news? You don’t need a six-figure salary to break the cycle. You just need a game plan … and a little persistence. Ready to learn how to not live paycheck to paycheck? Let’s talk real tools and practical tips that can actually help you stop living paycheck to paycheck and start making real progress.

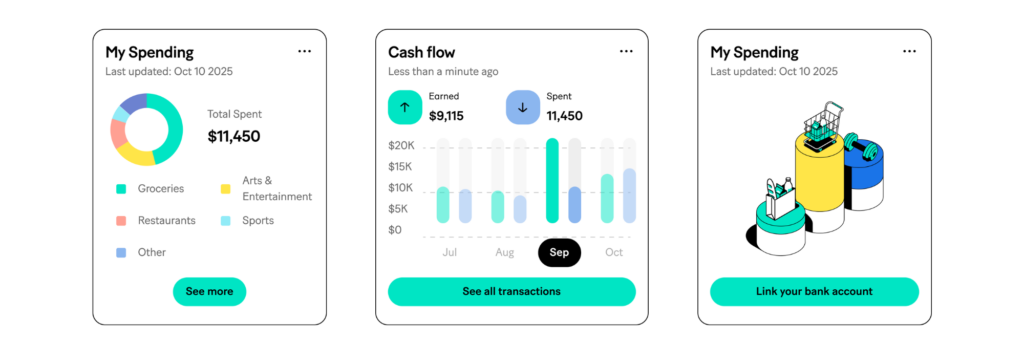

MoneyLion makes this easy with integrated budgeting, high-yield savings, round-ups, auto-saves, credit monitoring, and even cashback!

MoneyLion’s Instacash® lets you access up to $500 with 0% interest: no credit check, no hidden fees*. Use it when you’re stuck between paychecks and need help avoiding a bigger financial hit.

How we chose the 10 steps

Selection criteria and data sources

We selected steps that address the real pain points, you know, like having exactly $3.47 in your checking account three days after payday.

To come up with these top tips, we prioritized actions that actually move the needle, not just feel-good fluff. We conducted a combination of expert research and practical analysis. We referenced sources like the PYMNTS/LendingClub research, the People’s Policy Project, and real consumer data, along with insights from MoneyLion’s in-app budgeting and savings tools. We sought to present information that is both evidence-based and actionable for readers at different stages of their financial journey.

| Step | Potential monthly benefit |

| 1. Zero‑based budget | Capture more savings, as much as 5% to 12% |

| 2. Starter emergency fund | $150 to $300 saved via micro‑saves |

| 3. Pay high‑interest debt | Interest savings as much as $50 to $200+ |

| 4. Trim variable costs 10% | Could free up tens to hundreds of dollars |

| 5. Side gigs and extra income | Extra few hundred or even thousands of dollars |

| 6. Automate your savings and bills | On‑time payments can help you save on fees |

| 7. Strengthen your credit | Access as much as 1% to 2% APR lower on loans |

| 8. Renegotiate your bills | You could get as much as 5% to 10% off rent or bills |

| 9. Set SMART goals | Stay motivated and keep progress on-track |

| 10. Mindful spending | Fewer impulse buys |

#1 Create a zero‑based budget

What a zero‑based budget looks like

Zero-based budgeting (ZBB) is where you allocate every dollar of your income to specific expenses, savings, or debt payments until you reach zero, rather than basing your budget on previous spending patterns.

Here’s a simple template that actually works:

- Income: Paychecks, side hustles, that $20 your aunt sent

- Fixed expenses: Rent or mortgage, utilities, insurance, minimum debt payments (the non-negotiables)

- Variable expenses: Groceries, gas, dining out, retail therapy

- Savings: Emergency fund, sinking funds (because car repairs always happen)

- Debt repayment: Make extra payments above minimums

Adjust categories as needed, but every dollar gets assigned. No more “mystery spending”.

Tools to set it up quickly

MoneyLion’s budgeting dashboard can be a helpful way to stay on top of your dollars. It integrates budgeting, savings, and credit monitoring because who has time for five different apps?

Key features:

- Automatic transaction imports (no manual data entry)

- Smart expense categorization

- Monthly limits per category with alerts

- Weekly reviews and real-time reallocations

#2 Build a starter emergency fund

Why a three‑month cushion matters

Here’s the harsh reality: Anywhere from 24% to 42% of Americans do not have an emergency fund. That means a good chunk of adults are one car repair away from a potential financial disaster. A three-month emergency fund can act as a cushion to cover essential expenses without maxing out credit cards like it’s Black Friday.

Automate small daily savings

Start small because Rome wasn’t built in a day, and neither is financial stability:

- Round-ups: Every purchase rounds to the nearest dollar; spare change goes to savings (it’s like a tip jar for your future self)

- Daily auto-saves: $5 to $10/day can build $150 to $300/month (just think of it as skipping one overpriced coffee)

- Weekly sweeps: Transfer surpluses from under-budgeted categories

MoneyLion high‑yield savings account

Use MoneyLion to find high-yield savings account offers to actually grow your emergency fund instead of letting it collect dust.

#3 Pay down debt with the smallest balance first

Debt avalanche vs. snowball explained

Let’s break down two key debt repayment strategies:

- Debt avalanche: Pay extra toward the highest APR first (may have the most savings potential)

- Debt snowball: Pay extra toward the smallest balance first (may have more psychological benefits with quick wins that boost motivation)

| Debt Method | Best for | Interest savings potential | Motivation boost |

| Avalanche | People who prioritize minimizing cost and can stick to a plan | Generally higher (more efficient) | Moderate. Progress may be slower initially |

| Snowball | People who need quick wins | Generally lower (less efficient) | Strong. Early “wins” by eliminating debts faster |

Research shows that people living paycheck to paycheck often struggle with staying motivated [1]; so the snowball method can be especially effective in this regard. Small wins that keep you consistent are far better than slow progress that’s hard to maintain.

MoneyLion loan‑refinance option

If your credit score isn’t too shabby (620+ score), consider refinancing to a lower APR. Consolidating a 15% APR credit card into an 8% APR loan could help you save, either in monthly payments or in total interest paid over the long run. There’s no hard credit check to explore what offers you could qualify for from our trusted partners.

#4 Trim variable expenses by 10 percent

Spothidden spending leaks

Time for a spending audit that’ll make you question your life choices:

- Unused subscriptions (looking at you, gym membership from 2019)

- Food delivery apps that know you better than your family

- Streaming services you forgot existed

👉 How to Stop Spending Money: 16 Strategies to Take Control of Your Finances

Use MoneyLion to track subscriptions

Connect your bank account in the MoneyLion app, and get a handy insight card with your tracked subscriptions and how much is going to them each month. It takes no extra work – just set it, and you can review at any time.

#5 Boost your income with side gigs

Matching your skills to gig platforms

Time to monetize your talents (yes, even weird ones):

- Freelance: Upwork, Fiverr (got skills? Get paid)

- Delivery: DoorDash, Uber (turn your car into a potential money machine)

- Microtasks: Amazon MTurk (death by a thousand small payments)

👉 30 Best Side Hustle Jobs in 2025

Managing extra earnings efficiently

Deposit side-gig income into an “extra earnings” envelope. Allocate percentages for debt, savings, and fun, because all work and no play makes Jack broke and miserable.

Use MoneyLion to explore and find side hustles

Turn your spare time into spare cash! Explore side hustles you can do on your phone, online, through paid referrals, and more. MoneyLion’s made it easy to find ways to make more money.

Use MoneyLion’s cash advance to bridge the gap between paydays

Access MoneyLion Instacash for short-term needs. You could access up to $500 with no interest, no credit check, and no monthly fees.* It’s not a loan, but an advance on your future earnings. Repayment is automatically deducted from your next deposit to avoid the payday loan trap that keeps people broke.

#6 Automate savings and bill payments

Set up recurring transfers

Automating transfers to your savings ensures you consistently set money aside before you can spend it, making it easier to build your savings without thinking twice.

Schedule transfers from checking to savings accounts on payday, then automate bill payments. Late fees are just donations to companies you don’t even like.

Use MoneyLion’s round‑up feature

Activate MoneyLion round-ups to automatically invest spare change**. It’s like finding money in your couch cushions, but digital and consistent.

#7 Strengthen your credit score

Why credit matters for borrowing costs

A higher credit score can lower loan APRs by 1 to 2 percentage points. That’s real money saved; it’s almost like getting a discount on everything you finance.

For a fast credit score boost, lower your credit‑card utilization

Two moves that can help:

- Pay down balances before the statement closing date

- Request higher limits on well-managed cards (more available credit = lower utilization)

👉 How to Improve Credit Score: 10 Tips & Advice

MoneyLion’s credit‑monitoring service

Enroll for real-time score updates and personalized action items. MoneyLion can help you monitor your credit score and identify fast moves to help improve it without the guesswork. And if you really want to take things to the next level, check out MoneyLion’s Credit Builder Plus membership.

#8 Review and renegotiate major bills or contracts

Time your renegotiation for maximum leverage

Try to negotiate contracts or bills 30 days before expiration or after positive credit events. Companies often want to keep current customers more than they want to find new ones.

Sample scripts for landlords and providers

- Rent: “Can we renew at $Y, given my perfect payment history and the fact that finding new tenants is expensive?”

- Utilities or mobile: “I found a lower plan elsewhere. Can you match it or should I switch?”

#9 Set clear financial goals and track them

SMART goal framework

Use SMART goals: Specific, Measurable, Achievable, Relevant, Time-bound. SMART goals turn vague intentions into actionable plans, making it clear exactly what you need to do, by when, and how you’ll measure success. “Get rich” isn’t a goal; it’s a wish. “Save $5,000 in 10 months” is a plan.

Track your financial goals

Use a budgeting app, spreadsheet, or even a simple notebook to record your progress each month. Compare your actual savings, spending, or debt payoff to your targets, and celebrate small wins along the way. If you fall behind, adjust your timeline or contributions instead of abandoning the goal altogether.

#10 Adopt a mindful spending mindset

Delay tactics for impulse buys

Implement a 24-hour rule for non-essentials. If you still want it tomorrow, maybe it’s worth buying. Spoiler alert: you usually won’t.

Habit tracking and reward systems

Log “no-spend days” and celebrate milestones with low-cost rewards. With MoneyLion, you get access to an online community where you can connect with people on the same journey, share tips, insights and more.

What does it mean to live paycheck to paycheck?

In 2025, the percentage of Americans who are living paycheck to paycheck is anywhere from 34% to a whopping 60%. And consumer behavior data shows up to 48% of Americans report having zero discretionary money after bills. Zero. Zilch. Nada.

The main idea of living paycheck to paycheck is that your income barely covers your expenses with little or no money left over to save, invest, or handle a surprise bill. There’s no breathing room. No safety net. And every new expense (a flat tire, a medical bill, your kid’s field trip) feels like a financial emergency.

But the good news is, living paycheck to paycheck doesn’t have to be permanent, small, consistent changes can create real breathing room and help you start building financial stability over time.

Your Top Insights

Your money’s moving right now—don’t find out too late.

FAQs

How long does it take to break the paycheck‑to‑paycheck cycle?

Breaking the paycheck-to-paycheck cycle can take anywhere from a few weeks to even years. It all boils down to creating consistent habits, sticking to a realistic budget, avoiding overspending, and steadily building savings while managing debt.

What if I have irregular income?

Use a baseline budget based on your lowest predictable month. Cover essentials first, then allocate surplus to savings and debt when the good months hit.

How much should I save each month if I’m debt-free?

Many experts recommend the 50/30/20 rule, which suggests 20% of your income should go to savings. However, it’s always best to save more if you can afford it. And if 20% is a stretch, focus on building your emergency cushion first, then split additional savings between retirement and short-term goals.

What if an emergency wipes out my savings?

Try to rebuild quickly by increasing daily round-ups and auto-saves. Start with a one-month mini-fund, something is better than nothing.

Can I use a cash advance without falling back into debt?

Yes, if used as a short-term solution, repaid promptly, and not for discretionary purchases. Don’t use it for wants; save it for actual needs.

How do I stay motivated over the long term?

Set SMART milestones, celebrate small wins, and join the MoneyLion community! Surround yourself with people who get it.